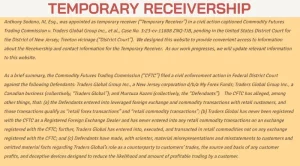

Update: Myforexfunds is no longer operational due to fraud investigation

MyForexFunds and FTMO are two reputable proprietary trading companies that provide their clients with a variety of funding programme choices and trading platforms. Both firms are known for giving traders performance coaching and offering top-notch customer service.

The two businesses do, however, differ significantly in some important ways. In order to assist you choose which company would be the greatest fit for you, we will evaluate the key features and offerings of MyForexFunds vs FTMO in this post.

The date of incorporation is one of the key distinctions between the two businesses; FTMO was founded in September 2015, while MyForexFunds was established in July 2020.

Myforexfunds vs FTMO Pricing

| Account Size | MyForexFunds | FTMO (normal risk) | FTMO (aggressive risk) |

|---|---|---|---|

| $5,000 | $49 | Not available | Not available |

| $10,000 | $84 | €155 | €250 |

| $20,000 | $139 | Not available | Not available |

| $25,000 | Not available | €250 | €345 |

| $50,000 | $299 | €345 | €540 |

| $100,000 | $499 | €540 | €1,080 |

| $200,000 | $979 | €1,080 | Not available |

| $300,000 | $1,389 | Not available | Not available |

Pricing for various account sizes is another crucial factor to take into mind. MyForexFunds and FTMO have various account sizes with various costs. Traders Global Group is the broker for MyForexFunds, and FTMO has a Tier-1 Liquidity Provider with Direct Market Access.

Both firms provide access to MetaTrader 4 and MetaTrader 5, with FTMO also providing access to cTrader, when it comes to trading platforms and instruments.

MForex Funds allows trading on currency pairs, commodities, indices, and cryptocurrency, whereas FTMO allows trading on currency pairs, commodities, indices, stocks, bonds, and cryptocurrency.

Finally, Trustpilot users have given both companies positive reviews, with MyForexFunds receiving a score of 4.9/5 from 6,076 reviews and FTMO receiving a score of 4.9/5 from 3,055 reviews.

| ||

|---|---|---|

| Feature | MyForexFunds | FTMO |

| Company Founded | July 2020 | September 2015 |

| Phase 1 profit target (two-phase) | 8% | 10% |

| Phase 2 profit target (two-phase) | 5% | 5% (normal risk), 10% (aggressive risk) |

| Daily drawdown (two-phase) | 5% | 5% (normal risk), 10% (aggressive risk) |

| Overall drawdown (two-phase) | 12% | 10% (normal risk), 20% (aggressive risk) |

| Leverage (two-phase) | 1:100 | 1:30 up to 1:100 (normal risk and aggressive risk) |

| Minimum trading days (two-phase) | 5 calendar days | 10 calendar days (normal risk and aggressive risk) |

| Phase 1 trading period (two-phase) | 30 calendar days | 30 calendar days (normal risk and aggressive risk) |

| Phase 2 trading period (two-phase) | 60 calendar days | 60 calendar days (normal risk and aggressive risk) |

| Profit split (two-phase) | 75% up to 85% | 80% up to 90% (normal risk and aggressive risk) |

| Account size vs fees | varies | varies |

| Broker | Traders Global Group | Tier-1 Liquidity Provider with Direct Market Access |

| Trading platform | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, cTrader |

| Forex pairs | Available | Available |

| Commodities | Available | Available |

| Indices | Available | Available |

| Stocks | Not available | Available |

| Bonds | Not available | Available |

| Crypto | Available | Available |

| Trustpilot rating | 4.9/5 | 4.9/5 |

| Number of reviews | 6,076 | 3,055 |

Account Types

| Comparison Criteria | MyForexFunds | FTMO |

|---|---|---|

| Account Types | Rapid, Evaluation, Accelerated | Normal Challenge, Aggressive Challenge |

| One-phase evaluation | Yes | No |

| Two-phase evaluation | Yes | Yes |

| Direct funding | Yes | No |

| Leverage | 1:100 for Evaluation Plan, up to 1:500 for Rapid and Accelerated Plans | 1:30 up to 1:100 |

| Profit Targets | 8% for Phase 1 and 5% for Phase 2 of Evaluation Plan | 10% for Stage 1, 5% for Stage 2 in Normal Challenge and 20% for Stage 1, 10% for Stage 2 in Aggressive Challenge |

| Daily Drawdown | 5% for all plans | 5% for Normal Challenge, 10% for Aggressive Challenge |

| Overall Drawdown | 12% for Rapid and Evaluation Plans, 10% for Accelerated Plan | 10% for Normal Challenge, 20% for Aggressive Challenge |

| Minimum Trading Days | 5 calendar days for Rapid and Evaluation Plans | 10 calendar days for both Normal and Aggressive Challenge |

| Trading Periods | 30 calendar days for Phase 1 and 60 calendar days for Phase 2 of Evaluation Plan | 30 calendar days for Stage 1, 60 calendar days for Stage 2 for both Normal and Aggressive Challenge |

| Profit Split | 75% up to 85% for Evaluation Plan, 80% up to 85% for Accelerated Plan | 80% up to 90% for both Normal and Aggressive Challenge |

| Option for Swing Trading | Only in Evaluation Plan | Both in Normal and Aggressive Challenge |

MyForexFunds offers three account types to traders: Rapid, Evaluation, and Accelerated. The Rapid and Accelerated plans allow for instant funding, while the Evaluation plan requires a two-phase evaluation process.

Trading Rules

| Feature | MyForexFunds | FTMO Normal Risk | FTMO Aggressive Risk |

|---|---|---|---|

| Profit target (Phase 1) | 8% | 10% | 20% |

| Profit target (Phase 2) | 5% | 5% | 10% |

| Daily drawdown | 5% | 5% | 10% |

| Overall drawdown | 12% | 10% | 20% |

| Leverage | 1:100 | 1:30 – 1:100 | 1:30 – 1:100 |

| Minimum trading days | 5 days | 10 days | 10 days |

| Phase 1 trading period | 30 days | 30 days | 30 days |

| Phase 2 trading period | 60 days | 60 days | 60 days |

| Profit split | 75% – 85% | 80% – 90% | 80% – 90% |

Leverage varies between the different plans, with 1:100 for the Evaluation plan and up to 1:500 for the Rapid and Accelerated plans. The Evaluation plan has profit targets of 8% for Phase 1 and 5% for Phase 2, with a maximum daily drawdown of 5% and overall drawdown of 12%.

FTMO, on the other hand, has two account types: Normal Challenge and Aggressive Challenge. Both plans require a two-phase evaluation process, with different rules for the challenges.

The Normal Challenge has profit targets of 10% for Stage 1 and 5% for Stage 2, while the Aggressive Challenge has targets of 20% for Stage 1 and 10% for Stage 2. Leverage is offered at a ratio of 1:30 up to 1:100.

Conclusion

Finally, it should be noted that MyForexFunds and FTMO are both renowned and long-standing proprietary trading companies that give traders the chance to trade a range of financial assets. FTMO comes out as the obvious choice for traders wishing to further their trading careers, even though both platforms have distinctive features and various funding possibilities.

In addition to the usual FX, commodities, and cryptocurrencies, FTMO gives traders a wide variety of financial instruments to trade, such as stocks, bonds, and indices. They have a strict challenge process and offer a variety of account types to accommodate traders of all skill levels and trading styles. A significant benefit of the profit-sharing concept is that traders can receive up to 90% of their profits.

Additionally, FTMO has a solid reputation for providing exceptional customer service and educating its traders to improve their performance. Additionally, the platform provides a free trial and a refundable registration fee so that users can test it out before committing.

MyForexFunds is a newer company, but it is still well-known. They provide three funding options, a variety of trading instruments, and support for the MetaTrader 4 platform. But FTMO provides a more thorough experience and a clear route to profitable trading.

In conclusion, both firms have a solid reputation and give traders a chance to succeed, but FTMO provides more features and a clearer path to a lucrative trading career. If traders want to advance their trading, they should unquestionably think about using FTMO.

u003cstrongu003eWhat is better than FTMO?u003c/strongu003e

Both MyForexFunds and FTMO are trustworthy u003ca href=u0022https://cryptojourneyblog.com/best-prop-trading-firms/u0022 data-type=u0022postu0022 data-id=u0022152u0022u003eproprietary trading companiesu003c/au003e that have managed to build a solid name in the market. With the Rapid, Evaluation, and Accelerated plans providing possibilities for various types of traders, MyForexFunds gives more account type options. u003cbru003eu003cbru003eAs opposed to My Forex Funds, which does not facilitate trading of stocks and bonds, FTMO provides a wide selection of financial instruments to choose from.

u003cstrongu003eWho is the owner of Myforexfunds?u003c/strongu003e

u003cstrongu003eAnurag Jaiswal u003c/strongu003eu003cbru003eu003cbru003eFounder u0026amp; Chief Executive Officer at Sunshine Info Solutions, Inc.

Is the FTMO challenge worth it?

To pass the rigorous FTMO challenge evaluation process and receive access to live trading using FTMO’s funds, traders must achieve certain profit goals. Not many traders will be able to pass this process because it can be difficult. u003cbru003eu003cbru003eThe chance to trade with the firm’s capital and make a significant proportion of earnings, however, can be highly alluring for those who succeed in the task. Additionally, the organisation offers traders a free trial so they can test out the platform and decide whether it’s good for them.

How much do FTMO traders make?

The earnings potential of FTMO traders vary according on their performance and level of risk tolerance. u003cbru003eu003cbru003eAlthough traders should be aware that this is a maximum cap and that not all traders will achieve this level of income, FTMO features a distinctive profit-sharing scheme that allows traders to earn up to 90% of their profits.u003cbru003eu003cbru003eFTMO also provides a variety of plans with various obstacles and financial goals. Traders who successfully complete the company’s tasks will be allowed to use the company’s capital and keep a portion of the earnings they generate.u003cbru003eu003cbru003eIt’s important to remember that a trader’s income will depend on their abilities and risk-management plan. There is no assurance of profit in u003ca href=u0022https://cryptojourneyblog.com/prop-trading-firm-list/u0022 data-type=u0022postu0022 data-id=u0022766u0022u003eproprietary u003c/au003etrading, so investors should be ready for possible losses as well.u003cbru003eu003cbru003eIt’s also vital to keep in mind that the earning potential can not increase linearly over time; traders frequently experience both good and poor times.u003cbru003eOverall, FTMO traders have the ability to earn a sizable income, but it’s critical to take into account the amount of risk and effort necessary to reach that income.