I got interested in learning about Fidelcrest. From what I researched, it is a prop trading company that was founded in 2018 and has a large community of traders from various countries who speculate on the markets.

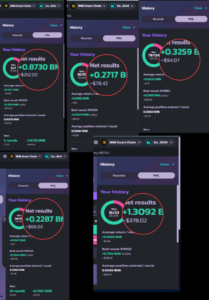

To join, it I paid a one-time fee and complete their challenge. When I successfully completed the challenge, I started to manage a significant amount of money and keep a high percentage of any profits I made.

It offers a range of account sizes and allows trading on various platforms and instruments, including forex and cryptocurrencies. Overall, Fidelcrest offers a lot of flexibility and opportunities for traders with different levels of experience and investment goals.

Fidelcrest Review

When I first started, I understood that the company operates on a 30-day trading period system. This means that once I open my first position, I had 30 days to complete all of my trades, and at the end of this period, my final profit or loss will be calculated.

During this time, I was free to follow my own trading strategy, which involved news trading, swing trading, holding positions overnight, and using stop/loss orders.

It’s worth noting that Fidelcrest has a set of strict rules that traders must follow, which are outlined in the Trader Agreement. These rules include guidelines for maximum daily loss and minimum trading days, and breaking any of these rules could have result in my account being cancelled.

All Fidelcrest accounts come with 1:100 leverage and allow the use of EAs on certain platforms. It’s important to carefully read and understand the terms and conditions outlined in the Trader Agreement to ensure that one is compliant with Fidelcrest’s rules.

How does Fidelcrest work?

- Choose an account: Fidelcrest offers 13 different accounts, depending on your preferred risk level and experience level. Consider which account size is most suitable for you and your investment goals.

- Choose a broker: Fidelcrest allows you to trade with seven different brokers and several platforms, including MetaTrader 4 and MetaTrader 5. Consider which broker and platform are the best fit for your trading style and needs.

- Complete the trading challenge: To complete the challenge, you will need to reach the minimum profit target on a demo account within a 30-day period. If you do not reach the target, you may be able to get a second try for free.

- Complete the funded verification: To complete verification, you will need to reach the profit target without reaching the maximum loss levels and submit your KYC documents. You can trade with real funds and earn up to 50% of the profits during this stage.

- Trade with your professional account: Once you complete the challenge and verification stages, you are officially a prop trader for Fidelcrest. You will be able to trade on a funded account without profit targets and keep up to 80% of the profits during the 30-day trading period. Make sure to follow the rules outlined in the Trader Agreement to avoid having your account cancelled.

- Consider scaling up your investments or moving to a larger account size: If you are progressing well with your professional account and want to invest more, you can contact Fidelcrest’s customer service team and sign up for the scaling plan. Alternatively, you can move to a larger account size with additional capital.

What is Fidelcrest?

Fidelcrest is a proprietary trading firm that offers individuals the opportunity to trade with the firm’s capital and keep a portion of the profits. Founded in 2018, the company claims to have more than 6,000 traders from over 170 countries. It offers a range of account sizes and the ability to trade through a variety of brokers and platforms, including forex and cryptocurrencies.

Fidelcrest operates in 30-day trading periods and has strict rules outlined in its Trader Agreement. It is important for individuals to carefully review these rules and any legal documents before committing to work with the firm. It is also advisable to do thorough research and due diligence when considering any investment opportunity, including prop trading firms.

How do I become a prop trader with Fidelcrest?

To become a qualified prop trader with this prop company, individuals must complete a trading challenge and funded verification process, which involves reaching certain profit targets and submitting KYC documents.

Once this process is completed, traders can trade on a funded account with no profit targets and keep up to 80% of the profits. Fidelcrest also offers the option to scale up investments and move to larger account sizes with additional capital.

What trading instruments are available through Fidelcrest?

Fidelcrest offers the ability to trade more than 1,000 instruments, including forex and cryptocurrencies.

Can I use expert advisors (EAs) with Fidelcrest?

Yes, EAs are allowed if permitted by the respective platform.

Are there any rules or restrictions I should be aware of when trading with Fidelcrest?

Fidelcrest has a set of rules outlined in its Trader Agreement, including maximum daily loss limits and minimum trading days. It is important for individuals to carefully review these rules before committing to work with the firm.

What are the risks of prop trading with Fidelcrest?

Prop trading carries inherent risks, including the possibility of losses. It is important for individuals to be aware of these risks and to carefully consider their own financial situation before committing to any investment. It is also advisable to thoroughly review any legal documents, such as a trading agreement, before making a decision.

Fidelcrest Vs FTMO

| Founded in 2018 | Founded in 2016 |

| Offers 13 different account sizes | Offers 3 different account sizes |

| Offers 1:100 leverage | Offers 1:200 leverage |

| Allows trade with 7 different brokers and several platforms | Allows trade with several brokers and platforms |

| Offers a trading challenge and funded verification process to become a prop trader | Offers a trading challenge and funded verification process to become a prop trader |

| Offers up to 80% profit split for prop traders | Offers up to 70% profit split for prop traders |

| Offers a scaling plan for increasing capital | Offers a scaling plan for increasing capital |

Pros And Cons

Pros of Fidelcrest:

- Flexibility: Fidelcrest offers 13 different account sizes to suit different experience and investment levels, allowing traders to choose an account that is most suitable for them.

- Leverage: It offers 1:100 leverage, which can help traders increase their potential returns.

- Wide range of trading instruments: Fidelcrest allows traders to trade a wide range of instruments, including forex and cryptos, through a range of top platforms and brokers.

- Thorough verification process: It has a thorough verification process in place to ensure that traders have a consistent strategy and are capable of hitting profit targets.

- Supportive community: It has a dedicated support team and a community of traders who can provide guidance and support.

- Potential for large profits: Fidelcrest allows traders to keep up to 80% of profits, which can be a significant amount.

Cons of Fidelcrest:

- One-off fee to get started: It requires traders to pay a one-off fee to get started.

- Strict rules: Fidelcrest has strict rules in place, detailed in the Trader Agreement, which traders must follow in order to avoid having their account cancelled.

- Risk of losses: As with any form of trading, there is a risk of losses when trading with Fidelcrest. It is important to carefully consider the risks involved and to do your own research and due diligence before committing to work with any prop firm.

Conclusion

Fidelcrest is a reputable prop trading firm that offers traders the opportunity to manage up to $400,000 and keep up to 80% of profits. The firm has a wide range of account sizes and allows traders to trade a variety of instruments through a range of top brokers and platforms.

It also has a thorough verification process in place to ensure that traders have a consistent strategy and are capable of hitting profit targets.

It also has a dedicated support team and a supportive community of traders who can provide guidance and support. Additionally, the firm offers a scaling plan for increasing capital, which can be a great opportunity for traders who are looking to grow their investment.

Overall, Fidelcrest is a reliable choice for traders who are looking for a prop trading firm with excellent training programs and a dedicated support team. It is important to carefully review the terms and conditions and to be aware of the risks involved in trading, including the possibility of losses, but Fidelcrest provides a solid platform for traders to achieve success in the markets.

Also Read the review on Best Prop Trading firms here