Plutus card review: Plutus is gaining massive popularity since the crypto.com announce of reduced cashback from their card purchase.

Plutus was founded by Danial Daychopan and is a london based company.

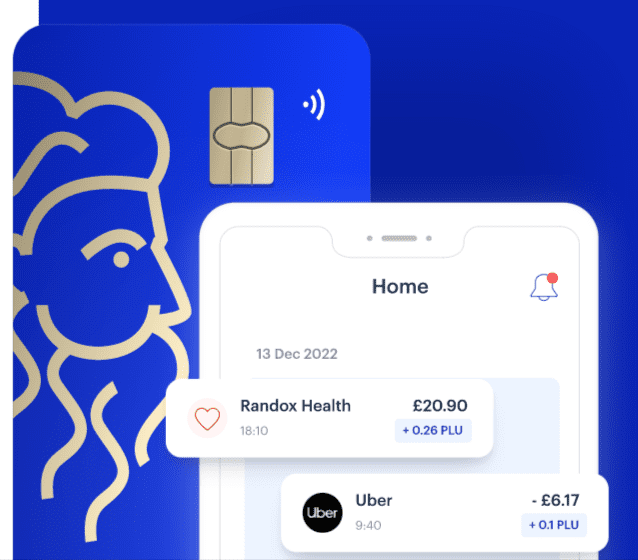

Since 2015, the Plutus platform has worked to integrate cryptocurrencies with conventional finance. The business that runs Plutus is primarily focused on its Visa card service, but it also runs a P2P exchange for its customers.

The Plutus Visa card has a lot of advantages, but it also has some disadvantages.

It offers variety of offers on the cashback like the early days of crypto.com card.

Every time you use a Visa Debit Card to make a purchase, even outside of the US, Plutus enables you to earn Crypto Rewards.

When you use the card to make purchases and payments, you will get payback reward in their native Pluton (PLU) token.

Contrary to other platforms that only allow trading between cryptocurrencies, PlutusDEX enables users to purchase ETH and PLU (Pluton) from other users using fiat money.

I’ve been fixated with finding a good cryptocurrency cashback card. Plutus comes to Top 5.

The rewards are decent, going from 3 percent to 8 percent cashback (if you are ballsy enough to stake some serious PLU).

With companies like Nexo, BlockFi, and Crypto.com, Plutus holds up nicely.

Thus, I present my evaluation of the Plutus Crypto Cashback Card and app.

How does the Plutus card work?

Plutus is a popular prepaid debit card that offers a number of benefits for users. The card is particularly appealing for those who want to earn rewards on their spending, as it allows users to earn Pluton tokens (PLU) for each transaction they make. This article will provide a detailed review of the card, including its features, benefits, and drawbacks.

Features of the Plutus Card

The card is a prepaid debit card that can be used anywhere that accepts Mastercard. This means that users can use the card to make purchases at millions of merchants around the world, both online and in-store.

One of the key features of the card is its rewards program. Every time a user makes a purchase with the card, they will earn Pluton tokens (PLU) which can be redeemed for a variety of rewards, including cash back and discounts on future purchases.

The card also comes with a number of other features that make it a convenient and user-friendly payment option. These include the ability to manage the card through a mobile app, access to 24/7 customer support, and the option to easily add funds to the card through a variety of methods, including bank transfer and cryptocurrency.

Benefits of the Plutus

Thecard offers a number of benefits for users, including:

- Rewards program: As mentioned above, one of the key benefits of the card is its rewards program. Users can earn Pluton tokens (PLU) for each transaction they make, which can be redeemed for a variety of rewards, including cash back and discounts on future purchases.

- Convenience: The card is a convenient payment option, as it can be used anywhere that accepts Mastercard. In addition, users can manage the card through a mobile app and easily add funds to it through a variety of methods.

- Security: The card offers a high level of security, as it uses advanced technology to protect users’ personal and financial information. This includes the use of EMV chip technology, which provides an additional layer of security for in-store transactions.

- Customer support: The card comes with 24/7 customer support, so users can get help with any issues or questions they may have about the card.

Plutus Stake Plan

The Plutus stake plan is a program offered by Plutus that allows users to earn additional rewards on their Pluton tokens (PLU) by staking them. Staking is the process of holding a certain amount of a cryptocurrency in a wallet to support the network and earn rewards.

When a user participates in the Plutus stake plan, they will be required to hold a minimum amount of PLU in their Plutus wallet for a certain period of time. In return, they will receive a share of the rewards generated by the Plutus network, in the form of additional PLU.

The amount of rewards a user can earn through the Plutus stake plan will depend on a few factors, including the amount of PLU they stake and the length of time they stake it for. Users who stake larger amounts of PLU for longer periods of time will generally earn more rewards than those who stake smaller amounts for shorter periods of time.

In addition to the rewards earned through staking, users who participate in the Plutus stake plan will also receive other benefits. These may include reduced fees, increased rewards on purchases made with the card, and early access to new features and products.

Overall, the Plutus stake plan is an attractive option for users who want to earn additional rewards on their PLU. By staking their tokens, users can support the Plutus network and earn a share of the rewards generated by the network, as well as enjoy other benefits.Try again

Drawbacks of the Plutus

Despite its many benefits, the Plutus card does have some drawbacks that users should be aware of. These include:

Limited acceptance: While the card can be used at millions of merchants around the world, there are still some merchants that do not accept Mastercard. This means that users may not be able to use the card at all merchants they want to.

Rewards program limitations: While the rewards program is one of the key benefits of the card, it does have some limitations. For example, the rewards may only be redeemable for certain types of purchases, and the value of the rewards may vary depending on the specific reward chosen.

Conclusion

Overall, the Plutus card is a convenient and rewarding payment option for those who want to earn rewards on their spending. While it does have some drawbacks, such as fees and limited acceptance, the card’s rewards program and other features make it a worthwhile option for many users.

In conclusion, the card offers a number of benefits for users, including a rewards program, convenience, security, and customer support. However, users should be aware of the fees associated with using the card, as well as its limited acceptance and limitations of the rewards program. Overall, the card is a good option for those who want to earn rewards on their spending, but it may not be the best choice for everyone.

One important thing to note is that the Plutus card is not a credit card, but rather a prepaid debit card. This means that users must load funds onto the card before they can use it to make purchases. This can be a convenient way to manage spending, but it also means that users cannot spend more than the amount of money they have loaded onto the card.